Intel Reclaims the Semiconductor Throne From Samsung

Don't let the lack of dragons fool you: the real "Game of Thrones" happens in the semiconductor market. According to IC Insights, the silicon throne once again belongs to Intel, with the DRAM market's decline ending Samsung's reign over the chip industry a little over a year after it began.

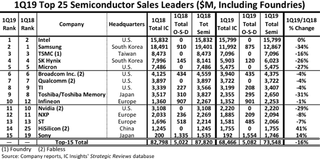

IC Insights announced Intel's return to the throne in a May 16 bulletin. The research firm explained: "While Samsung held the full-year number one ranking in 2017 and 2018, Intel is forecast to easily recapture the number one ranking for the full-year of 2019, a position it previously held from 1993 through 2016. With the collapse of the DRAM and NAND flash markets over the past year, a complete switch has occurred, with Samsung having 23% more total semiconductor sales than Intel in 1Q18 but Intel having 23% more semiconductor sales than Samsung just one year later in 1Q19!"

This switch was expected. Gartner said in April that Samsung would cede the semiconductor market throne to Intel this year because of its reliance on the DRAM market. The recent decline in memory prices was the fastest it's been since 2011, according to DRAMeXchange, and other analysts have predicted that the DRAM market would see double-digit losses in 2019. Gartner said that 88% of Samsung's revenues come from the DRAM market, which means these struggles were almost certainly going to make it difficult for the company to maintain its lead in the semiconductor market.

That has proved to be the case. Samsung issued an unprecedented earnings warning in March, and in April, the company revealed that its profits dropped by 60% in the first quarter of 2019. (Revenues only fell by 13%, which is a far less concerning amount, but shareholders are primarily interested in profit.) The current state of the DRAM market wasn't the only cause of that decline--the company also saw drops in its smartphone, display panel, and image sensor businesses--but it was perhaps the most important one. Until the memory market picks up, Samsung is unlikely to rise again.

There could be some good news for Samsung in that regard: DigiTimes reported on May 10 that companies expect memory module shipments to rise in 2Q19 while prices stabilize. Prices could also start to recover in Q3, the busiest quarter of the year for many tech companies, as demand also increases. But those rebounds aren't guaranteed, especially if the U.S.-China trade war and Intel's processor shortage continue to lay siege to the enthusiast market. Even if the DRAM market does improve as expected, it might not be enough to help Samsung defenestrate Intel from its throne any time soon.

IC Insights said more information about the semiconductor market's recent changes would be available "later this month" in the May Update to the 2019 McClean Report. "Overall, the 2Q19 semiconductor revenue expectations vary widely by company and currently span a range of 20 percentage points," the firm said. "As part of the May Update, IC Insights will also discuss its expectations for worldwide quarterly IC market growth for the remainder of this year."

We know that Intel's back on its throne--the question now is whether it leads a prosperous kingdom or an ever-shrinking pile of sand.

Stay on the Cutting Edge

Join the experts who read Tom's Hardware for the inside track on enthusiast PC tech news — and have for over 25 years. We'll send breaking news and in-depth reviews of CPUs, GPUs, AI, maker hardware and more straight to your inbox.

Nathaniel Mott is a freelance news and features writer for Tom's Hardware US, covering breaking news, security, and the silliest aspects of the tech industry.

Most Popular